Career Bio

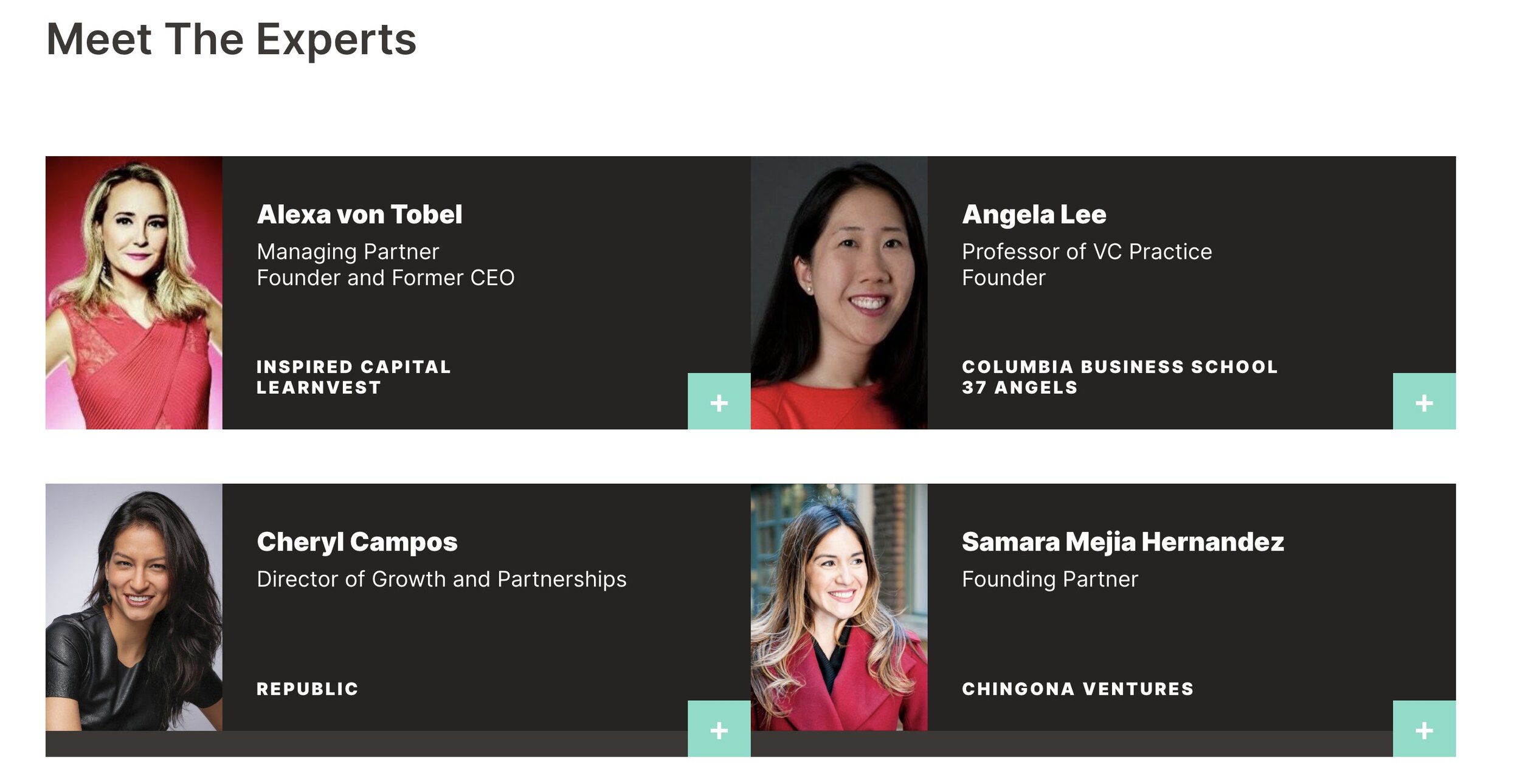

Cheryl is passionate about the intersection of finance, technology, and social impact. She is the Head of Venture Growth and Partnerships at Republic, an investment platform for founders to raise capital from both accredited and non-accredited investors. She joined as full-time employee #10 in 2018 and has been instrumental in its growth to unicorn status ($1BN valuation). In other direct investing roles, she is a scout for Lightspeed and an investment partner at The Community Fund, writing checks to 20+ companies in community centric startups, particularly healthcare and web3. Cheryl is also co-founder of VCFamilia, a community of 340+ Latinx investors supporting peers and founders through collaboration.

Previously she worked as an analyst in a Connecticut-based private debt & equity firm with an emphasis on minority and women entrepreneurs. She started her career in Investment Banking at Barclays, working in the Financial Institutions Group and Structured Finance. She holds a BA in Economics with honors from Harvard University and is a MBA candidate at Stanford Graduate School of Business Class of 2024.

Investment Thesis

I’m focused on investing in companies that improve people’s lives and wellbeing, broadly serving overlooked communities, and specifically interested in femtech (improving the lives of women through digital health) & silvertech (improving the quality of life of the elderly, because we’ll get there).

In femtech, I am interested in the following areas:

Post-partum treatment and care

Sexual health & wellness

Menopause solutions and services

For silvertech, I am bullish on:

Aging in place services

Deathtech

For web3, I’m investing in defi & infrastructure only.

VCFamilia

It has been the honor of a lifetime to have created the largest Latine venture ecosystem, normalizing our experiences and supporting those that come after us. We are supporting our 340+ members with connections, intersectionality chats, LP introductions, deal sourcing, activist opportunities, or simply new friends.

40 events / year around community and culture

$12M raised for Latinx emerging fund managers

60k+ slack messages (most of them DMs!)

Statements co-signed by USHCC, Angeles Investors & others

First national Latinx pitch competition led by Latinx investors

Hispanic Heritage Month done right

Partnerships include SVB, Techstars Accelerate Equity, Comcast

We are coming out with more exciting news soon. Stay tuned.

Supporting Founders

I’ve met thousands of founders during my time in tech and VC, learning about a myriad of industries and admiring their strength in a process filled with “no”s. Despite my limited bandwidth, I’ve made sure to assist in the following ways:

Republic RePost: Recurring email filled with grants, pitch opportunities, and other resources

Events: I’ve conducted 100s of events specifically for founders through Republic, VCFamilia, and accelerators to coach through angel rounds (see here for WeWork Labs), alternatives to VC and more. Follow me on twitter for the latest public events.

Pitch competitions: Through VCFamilia and other initiatives, I’ve been a host and judge of pitch competitions that support founders at the pre-seed and seed level.

More to come through new initiatives in the works.

Wall of Appreciation

I appear in places

Some examples:

Harlem Capital Podcast: More Equity

Hispanic Heritage Foundation: Technology Investing Growth

DeBroing Crypto: Link

TechMoney Podcast

Visible VC: Profile & Podcast

All Raise: Fall 2020 Reading List

HBS Black New Venture Competition Igniting Pathways for Black Entrepreneurs Medium

Confluence Profile & Podcast: Cheryl Campos

All Raise Visionary Voices

Startup Of the Year Summit - Pitch Judge

And I’ve been featured

Pitchbook - Startups with funds locked in SVB pray for a saving grace

VentureBeat - How Web3 and Cloud3 will power collaborative problem-solving and a stronger workforce

Institutional Investor - When Investors Overlook Latinx Founders, They Miss Out on a $1.4 Trillion Opportunity

Alliance for Entrepreneurial Equity - Women Wanted: The Equity Gap in Venture Capital